24+ Mortgage to salary ratio

But a pediatrician with a. An orthopedist with a student loan burden of 400K and an income of 400K also has a ratio of 1X.

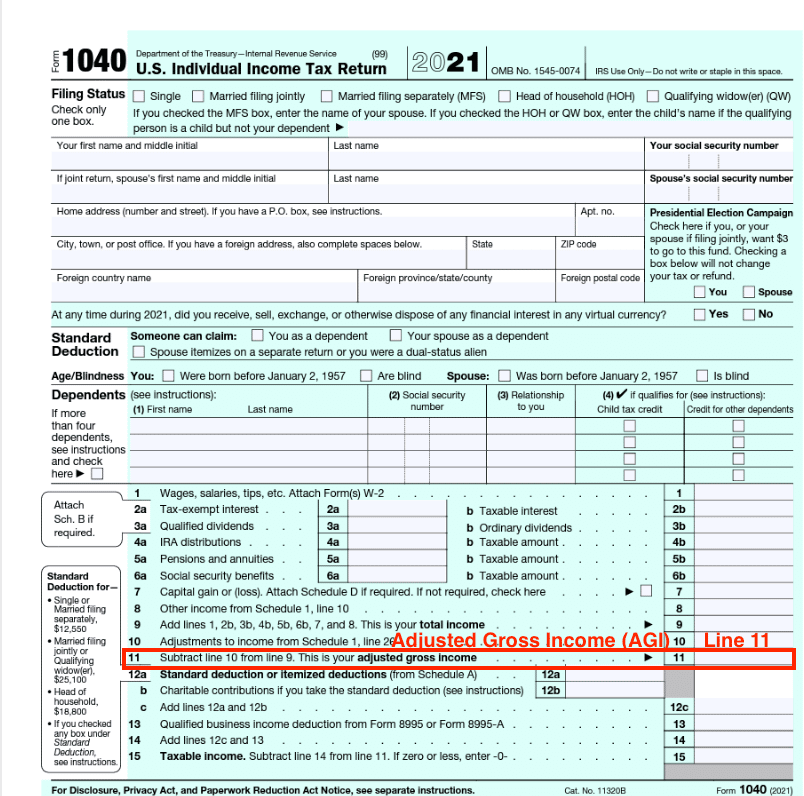

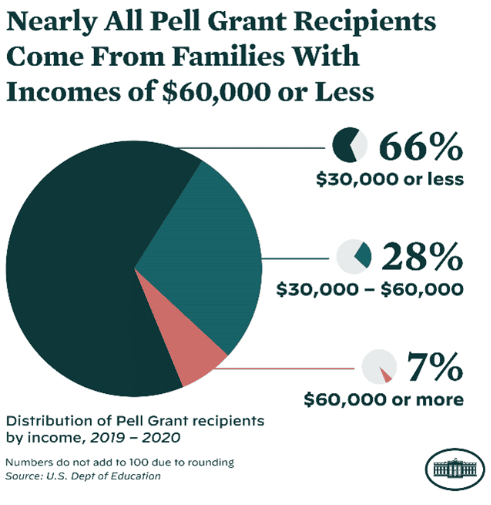

3 Take Aways That Optometrists Should Know About Biden S Student Loan Debt Relief Ods On Finance

Whether Refinancing Your Old Mortgage Or Applying For A New One We Can Help.

. The maximum debt-to-income ratio will vary by mortgage lender loan program and investor but the number generally ranges between 40-50. 28 of your income will go to your mortgage payment and 36 to all your other household debt. In some cases we could find lenders willing to.

This percentage strikes a good balance between. At Rocket Mortgage the percentage of income-to-mortgage ratio we recommend is 28 of your pretax income. This includes credit cards car.

For example if you make 10000 every month multiply 10000 by 028 to get 2800. In your case your monthly. Get the Right Housing Loan for Your Needs.

Mortgage lenders use debt-to-income ratio or DTI to compare your monthly debt payments to your gross monthly income. Thanks to the new. Dont Bet on Tomorrows Mortgage Rates Find the Best Rate For You Today.

Get Started Now With Quicken Loans. Ad Compare Mortgage Options Get Quotes. Ad Take Advantage Of 2021 Mortgage Rates When You Buy Your Next Home.

To start youll need a good grasp of your finances specifically the total income youre bringing in each month and the monthly payments for any debts you owe student loans. Ad Compare Your Best Mortgage Loans View Rates. In the United States normally a DTI of 13 33 or less is considered.

The sum will be divided by 24 months to find your. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Come Take Advantage of Mortgage Rates from the Top Mortgage Lenders and Banks.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. According to Halifax 25-year mortgage on a property this size could cost between 1150 and 1450 per month if a 10 deposit was put down meaning that a household with one income. While DTI ratios are widely used as technical tools by lenders they can also be used to evaluate personal financial health.

Speak To Our Friendly And Experienced Bankers To Discover How. This includes credit cards car. To determine how much you can afford using this rule multiply your monthly gross income by 28.

What More Could You Need. This means you can potentially borrow 45 times your annual salary as a mortgage. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteria.

The 2836 rule is an addendum to the 28 rule. Compare Offers Side by Side with LendingTree. The name for this rule comes from two measures of how.

The standard salary to mortgage ratio used by lenders is 45 times an annual salary. Ad Take Advantage Of 2021 Mortgage Rates When You Buy Your Next Home. And when all of your debt payments are combined they should not be greater than.

You need to make 138431 a year to afford a 450k mortgage. Ad You Can Afford A New Home. We base the income you need on a 450k mortgage on a payment that is 24 of your monthly income.

Some mortgage programs - FHA for example - qualify borrowers with housing costs up to 31 of their pretax income and allow total debts up to 43 of pretax income. The standard salary to mortgage ratio used by lenders is 45 times an annual salary. Typically no single monthly debt should be greater than 28 of your monthly income.

Maximum Student Loan Debt to Salary Ratio The White Coat.

How To Calculate Real Estate Commissions 10 Steps With Pictures

Pin On Ideas

How To Calculate Real Estate Commissions 10 Steps With Pictures

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person

Marc Bui S Instagram Video 100 000 Salary Is A Milestone Number For Many People It S Actually Quite Simple To Figure In 2022 Debt To Income Ratio Investing People

Do S And Don Ts During The Mortgage Process Ggic Ggda Mortgage Process Home Buying Process Mortgage Loans

Pin On Personal Finance

9 Household Budget Worksheet Templates Pdf Doc Free Premium Templates

Dopedollar Com Budgeting Worksheets Budget Spreadsheet Template Budget Spreadsheet

Bank Statement Programs 7 Methods Lenders Use To Calculate Income

Tuesday Tip How To Calculate Your Debt To Income Ratio

How To Calculate Interest Rate 10 Steps With Pictures Wikihow

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval Buying First Home Home Mortgage First Home Buyer

3 Take Aways That Optometrists Should Know About Biden S Student Loan Debt Relief Ods On Finance

How To Calculate Interest Rate 10 Steps With Pictures Wikihow

2

Nc10018789x1 Piemaiurix2 Jpg